The Very Best Mortgage Broker Provider in Omaha for First-Time Homebuyers

Discover the Perfect Mortgage Broker for Your Mortgage Needs

Choosing the right home mortgage broker is an important action in the home loan procedure, as the knowledge and resources they give can significantly impact your monetary result. Knowing where to begin in this search can usually be overwhelming, raising the inquiry of what particular top qualities and credentials truly established a broker apart in a competitive market.

Recognizing Home Mortgage Brokers

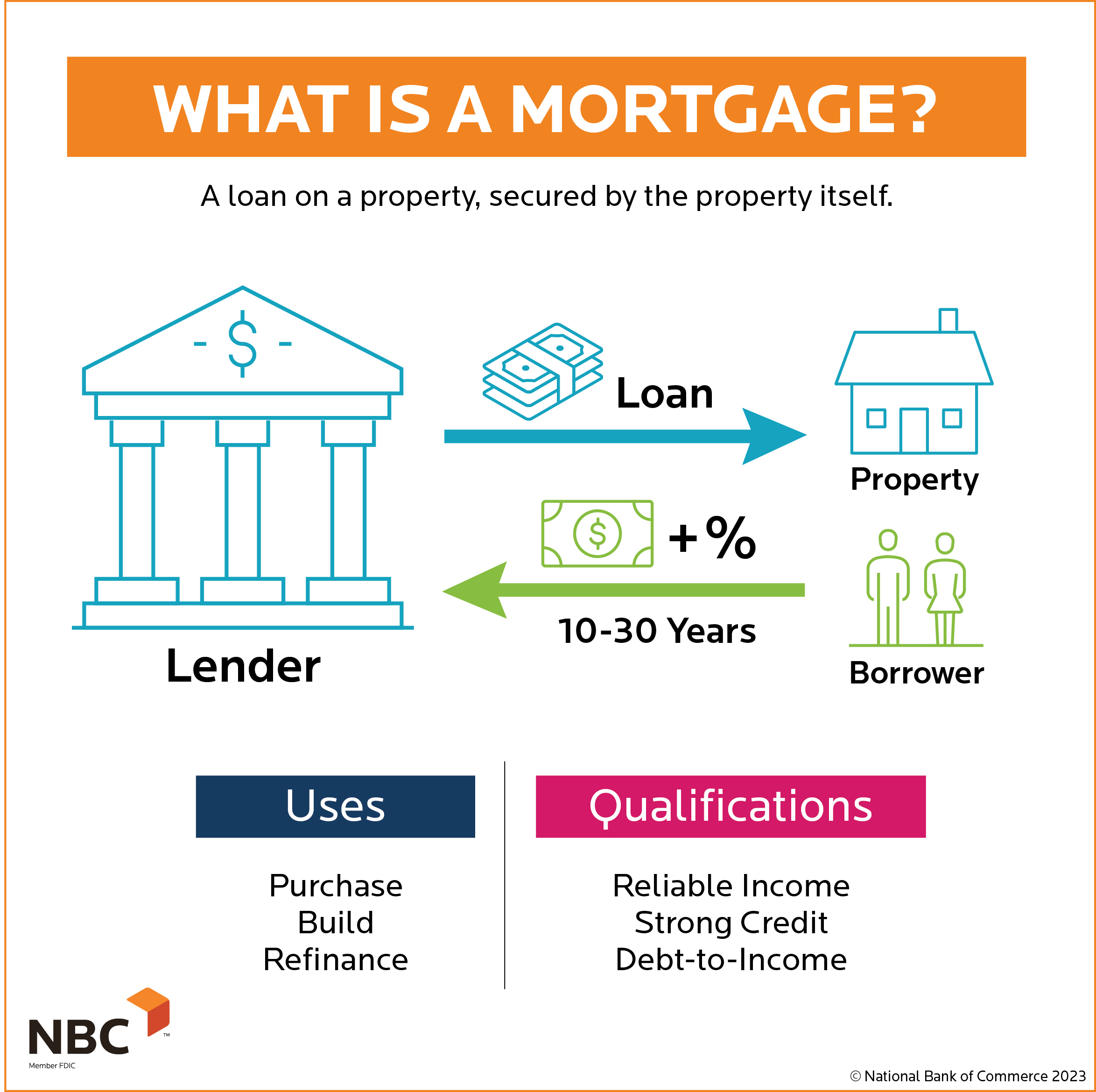

Comprehending mortgage brokers is crucial for browsing the complexities of home financing. Home loan brokers act as middlemans in between consumers and lending institutions, assisting in the procedure of protecting a home mortgage. They possess extensive knowledge of the lending landscape and are proficient at matching customers with ideal financing items based upon their monetary accounts.

A key function of mortgage brokers is to analyze a debtor's financial scenario, including credit report, income, and debt-to-income ratios. This assessment allows them to recommend home loan alternatives that line up with the debtor's abilities and demands. Additionally, brokers have accessibility to a range of loan providers, which allows them to existing multiple funding alternatives, possibly leading to a lot more beneficial terms and rates.

By using a home mortgage broker, debtors can conserve time and lower stress, making certain a much more educated and effective home financing experience. Understanding the duty and advantages of home loan brokers inevitably encourages property buyers to make informed choices throughout their home mortgage trip.

Secret High Qualities to Seek

When choosing a mortgage broker, there are several crucial qualities that can dramatically influence your home financing experience. Most importantly, look for a broker with a strong credibility and positive client testimonies. A broker with satisfied customers is likely to provide dependable solution and sound advice.

A broker with comprehensive market knowledge will certainly be better geared up to navigate intricate home loan choices and offer tailored options. A broker who can plainly describe processes and terms will guarantee you are well-informed throughout your mortgage trip.

Another essential top quality is transparency. A credible broker will honestly review fees, potential disputes of interest, and the whole lending process, enabling you to make educated decisions. Try to find a broker who demonstrates strong arrangement skills, as they can protect much better terms and prices on your part.

Finally, consider their availability and responsiveness. A broker that prioritizes your requirements and is conveniently obtainable will make your experience smoother and less stressful. By reviewing these essential high qualities, you will be better positioned to locate a mortgage broker that lines up with your home finance demands.

Questions to Ask Prospective Brokers

Picking the right home mortgage broker entails not only identifying crucial high qualities but additionally involving them with the ideal concerns to gauge their knowledge and fit for your requirements. Begin by inquiring about their experience in the market and the sorts of loans they focus on. This will help you recognize if they straighten with your specific financial situation and objectives.

Ask about their procedure for analyzing your financial health and wellness and figuring out the most effective home mortgage options. This concern reveals exactly how detailed Visit Your URL they remain in their technique. In addition, inquire about the series of lending institutions they collaborate with; a broker who has accessibility to multiple lenders can supply you more affordable prices and options.

:max_bytes(150000):strip_icc()/standing-mortgage.asp_Final-f243f07e8a22431ba1a4c32616f127a2.jpg)

You should also review their fee framework. Comprehending how they are compensated-- whether with ahead of time costs or payments-- will give you understanding into possible problems of interest. Finally, request referrals or testimonies from previous customers. This can offer useful details concerning their integrity and consumer solution. By asking these targeted inquiries, you can make a much more enlightened choice and find a broker who ideal matches your home funding demands.

Researching Broker Qualifications

Extensively looking into broker qualifications is a crucial action in the mortgage selection process. Ensuring that a home mortgage broker has the ideal credentials and licenses can significantly affect your mortgage experience - Mortgage Loans. Begin by confirming that the broker is licensed in your state, as each state has certain needs for home loan experts. You can usually locate this details via your state's regulative agency or the Nationwide Multistate Licensing System (NMLS)

Next, consider the broker's academic background and expert classifications. Credentials such as Qualified Home Loan Specialist (CMC) or Accredited Mortgage Expert (AMP) demonstrate a commitment to ongoing education and learning and professionalism and trust in the field. Additionally, exploring the broker's experience can provide insight right into their proficiency. A broker with a proven track document in efficiently closing lendings comparable to yours is very useful.

Additionally, check out any corrective actions or problems lodged versus the broker. On-line reviews and endorsements can offer a peek right into the experiences of past customers, aiding you analyze the broker's reputation. Ultimately, complete study into broker credentials will encourage you to make an educated choice, fostering self-confidence in your home mortgage procedure and enhancing your overall home acquiring experience.

Examining Costs and Providers

Reviewing fees and solutions is usually a critical element of selecting the ideal home loan broker. Brokers usually charge costs in numerous kinds, consisting of source fees, handling costs, and commission-based repayments. It is necessary to understand these fees upfront to stay clear of any kind of shocks throughout the closing process. Transparency in charge structures enables you to contrast brokers effectively and assess the total cost of getting a home mortgage.

In enhancement to costs, consider the array of services used by each broker. Some brokers provide an extensive collection of services, including economic consultation, support with documentation, and ongoing support throughout the financing process.

When assessing a broker, inquire concerning their desire, schedule, and responsiveness to address questions. A broker who prioritizes customer care can make a substantial distinction in browsing Web Site the intricacies of home mortgage applications. Inevitably, understanding both fees and services will empower you to choose a home loan broker that straightens with your financial needs and expectations, guaranteeing a smooth path to homeownership.

Conclusion

Finally, picking a proper mortgage broker is important for accomplishing desirable car loan terms and a streamlined application process. By focusing on brokers with strong track records, substantial experience, and access to multiple lending institutions, people can boost their possibilities of protecting competitive rates. Furthermore, assessing communication abilities, charge structures, and total openness will add to a much more educated decision. Inevitably, a credible and well-informed home mortgage broker offers as an important ally in browsing the complexities of the home mortgage landscape.

Selecting the ideal mortgage broker is a vital action in the home funding process, as the knowledge and sources they offer can dramatically impact your monetary end result. Home mortgage brokers serve as middlemans in Mortgage Lenders Omaha between loan providers and borrowers, helping with the procedure of protecting a home mortgage. Understanding the role and benefits of home mortgage brokers ultimately equips property buyers to make educated choices throughout their home mortgage journey.

Guaranteeing that a home loan broker has the suitable certifications and licenses can dramatically impact your home car loan experience. Inevitably, a knowledgeable and trustworthy home loan broker offers as a valuable ally in navigating the complexities of the mortgage landscape.